When buying a home, choosing the right mortgage term is just as important as finding the perfect property. In Canada, most homebuyers opt for a 25-year mortgage, but did you know that 30-year mortgages are available for those with a 20% down payment or more?

A longer mortgage term comes with pros and cons, and understanding them can help you make a smarter financial decision. Let’s explore whether a 30-year mortgage is the right fit for you.

What is a 30-Year Mortgage?

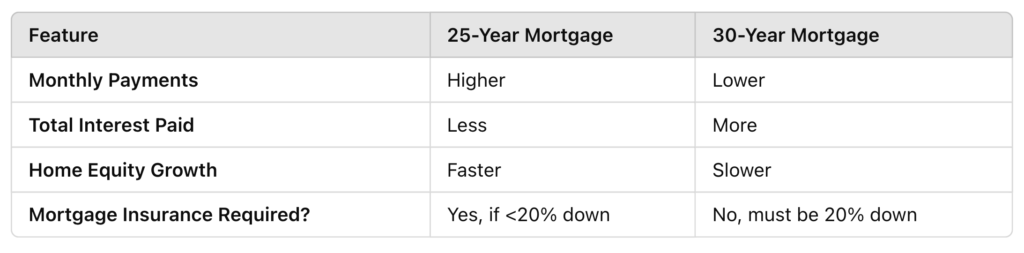

A 30-year mortgage spreads your loan payments over a longer period, reducing your monthly payment amount compared to a shorter term, such as a 25-year mortgage. However, this also means you’ll pay more interest over time.

Benefits of a 30-Year Mortgage

✔ Lower Monthly Payments – Since your loan is stretched over a longer period, each monthly payment is lower, making homeownership more affordable.

✔ More Budget Flexibility – Lower payments free up cash for other financial goals like investments, renovations, or travel.

✔ Easier Qualification – Lower payments can help improve your debt-to-income ratio, making it easier to qualify for a mortgage.

✔ Extra Prepayment Options – Many lenders allow you to make extra payments or pay off your mortgage faster without penalties, reducing interest costs.

Drawbacks of a 30-Year Mortgage

❌ Higher Interest Costs – Since you’re borrowing for longer, you’ll end up paying more interest over time compared to a shorter mortgage.

❌ Slower Equity Growth – With lower payments, you’ll build equity in your home more slowly than with a shorter-term mortgage.

❌ Limited to 20% Down Payment or More – If your down payment is less than 20%, you must stick to a maximum 25-year amortization due to mortgage insurance rules.

Is a 30-Year Mortgage Right for You?

A 30-year mortgage might be a good option if:

✅ You prefer lower monthly payments for better cash flow.

✅ You plan to invest the extra savings elsewhere.

✅ You want more financial flexibility, especially if you’re self-employed or have fluctuating income.

On the other hand, a shorter mortgage (e.g., 25 years) may be better if:

✔ You want to pay less interest over time.

✔ You aim to build home equity faster.

✔ You’re comfortable with higher monthly payments.

Talk to a Mortgage Expert

Choosing the right mortgage term is a big decision that impacts your finances for years to come. At Sheth Mortgages, we help homebuyers find the best mortgage solution based on their goals and budget.

📞 Need expert advice? Let’s chat and find the perfect mortgage for you!